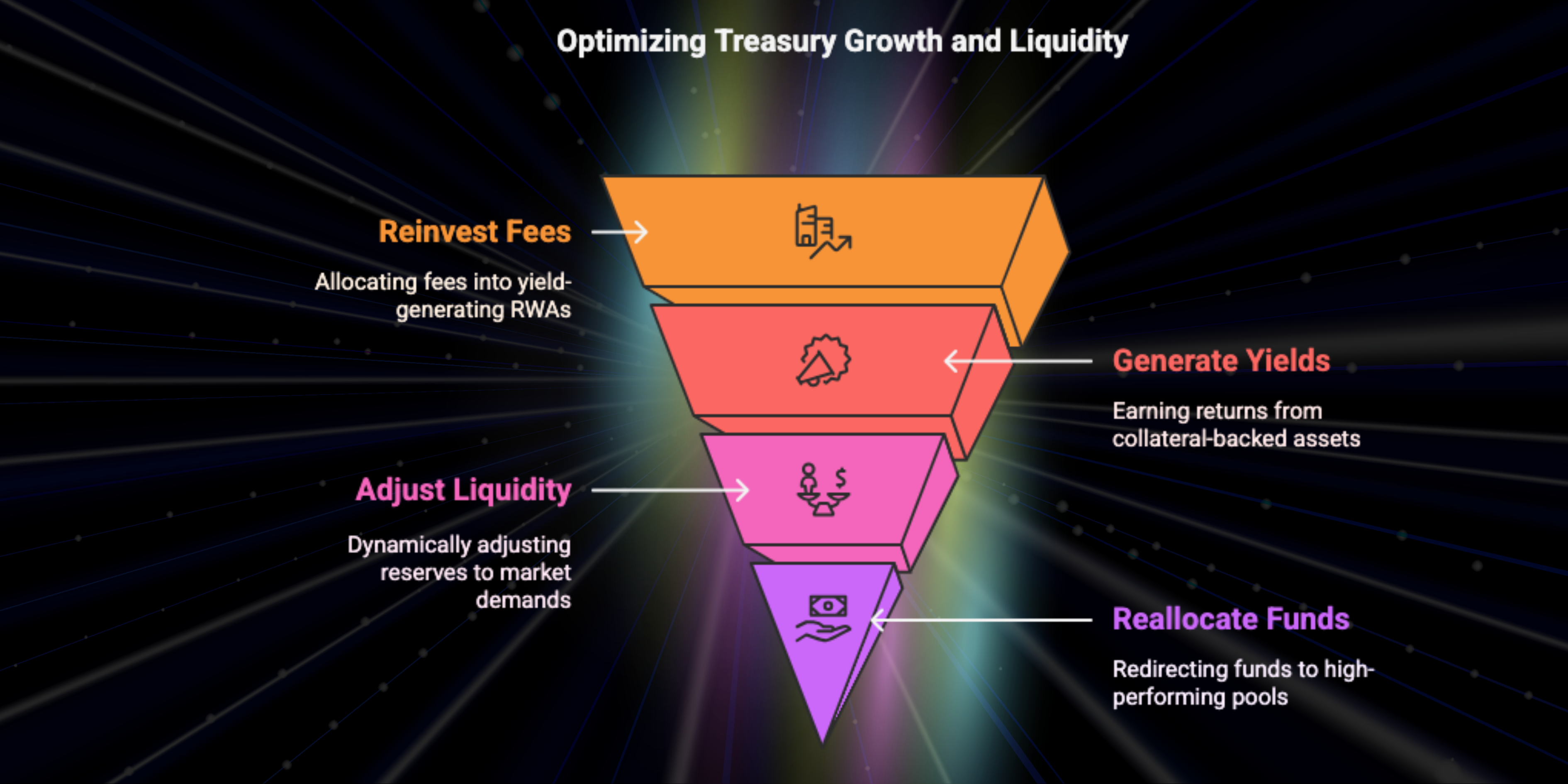

Sustainable Treasury Growth And Liquidity

STBL's treasury management system is designed to ensure long-term sustainability and liquidity stability. Through a combination of reinvestment strategies, dynamic yield mechanisms, and automated fund reallocation, the protocol maintains a self-sustaining financial ecosystem.

1. Reinvestment of Protocol Fees into Yield-Generating RWAs

A portion of protocol-generated fees is strategically reinvested into tokenized real-world assets (RWAs), ensuring that treasury reserves continue to grow.

- Collateral-backed yield generation: Funds are allocated into high-yield RWAs, including U.S. Treasury Bills.

- Sustainable fee extraction model: The Yield Pool extracts a portion of yield payments, directing them back into the treasury, creating a compounding effect.

- Treasury-backed stability: Ensures that every USST in circulation remains fully collateralized. By continuously reinvesting protocol fees, STBL enhances capital efficiency while maintaining financial resilience.

2. Dynamic Yield Strategies for Liquidity Stability

STBL incorporates a dynamic treasury model, allowing for automated liquidity adjustments based on market conditions.

- Treasury reserves automatically adapt to market demand, allocating additional liquidity when needed.

- Yield-bearing YLD tokens are generated, ensuring continuous incentives for liquidity providers.

- LAMP (Liquidity and Minting Pool) optimizes on-chain capital distribution, preventing supply-demand imbalances. Through automated dynamic yield allocation, STBL ensures stable liquidity provisioning and smooth transactions.

3. Automated Fund Reallocation for Treasury Optimization

To maintain optimal treasury reserves, the protocol employs an automated reallocation mechanism that:

- Monitors market trends and adjusts fund allocation to high-performing asset pools.

- Redirects surplus liquidity to ecosystem expansion initiatives and governance-driven development.

- Ensures capital efficiency, reducing risks related to asset underutilization