Understanding Delegated Staking

Delegated staking allows users who may not want to actively participate in governance or staking processes to delegate their rights to others. This mechanism provides opportunities for specialized entities, such as liquidity providers, institutional investors, or governance delegates, to leverage staking rights effectively. In return, token holders may receive a portion of the staking rewards or other incentives, creating a mutually beneficial relationship.

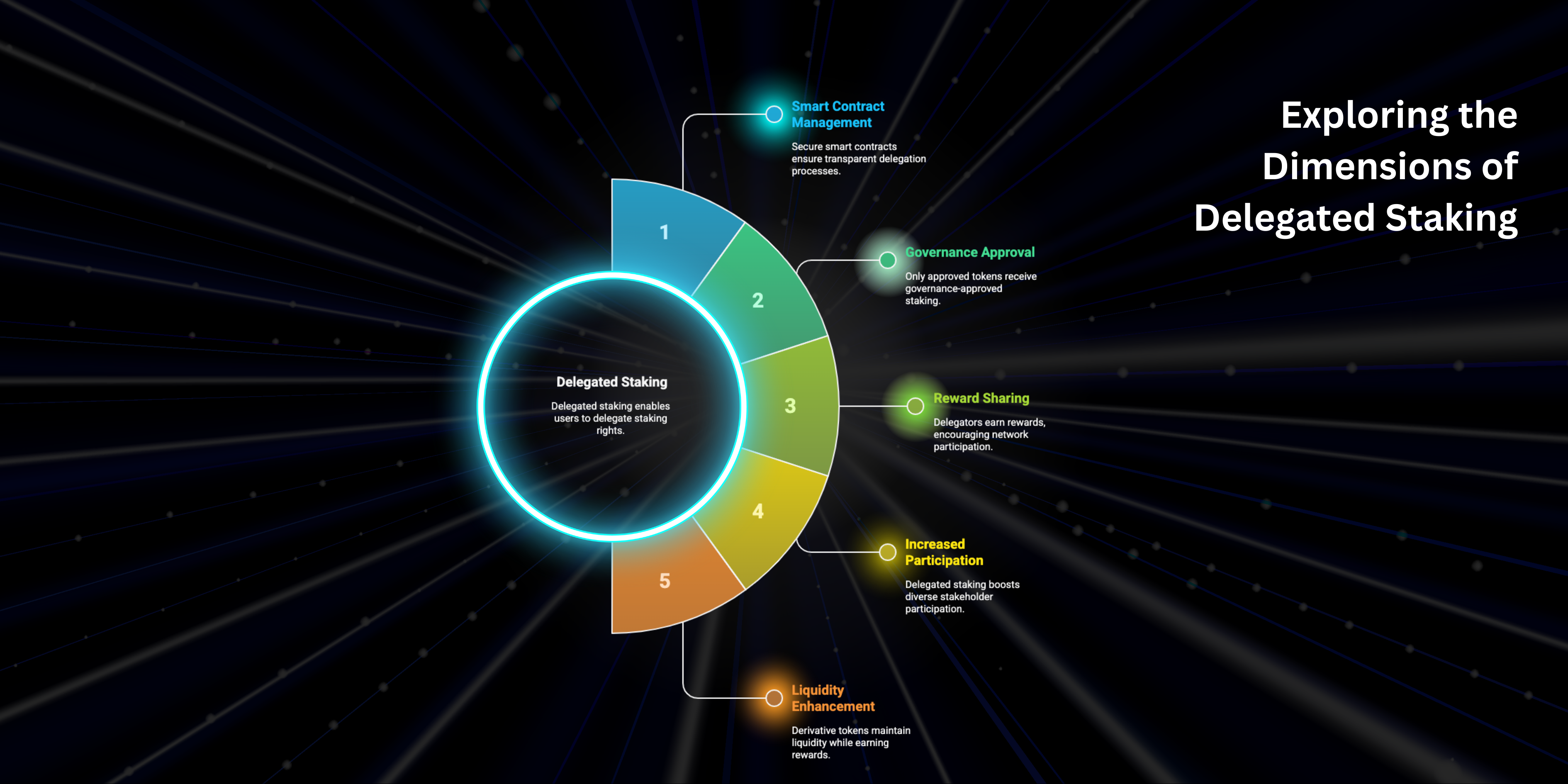

Key Features of Delegated Staking

- Smart Contract Management: All staking rights assignments are executed via secure smart contracts, reducing the risk of fraud or misuse.

- Governance Approval: Only approved derivative tokens are eligible for delegated staking, ensuring a secure and compliant environment.

- Reward Sharing: Delegators may earn a portion of staking rewards, incentivizing participation in the network.

- Increased Participation: Users who lack the time, resources, or expertise to engage in active governance can still contribute by delegating their voting rights.

- Liquidity Enhancement: By issuing derivative tokens that represent staked assets, users can maintain liquidity without sacrificing staking rewards.