Benefits Of Delegated Staking

-

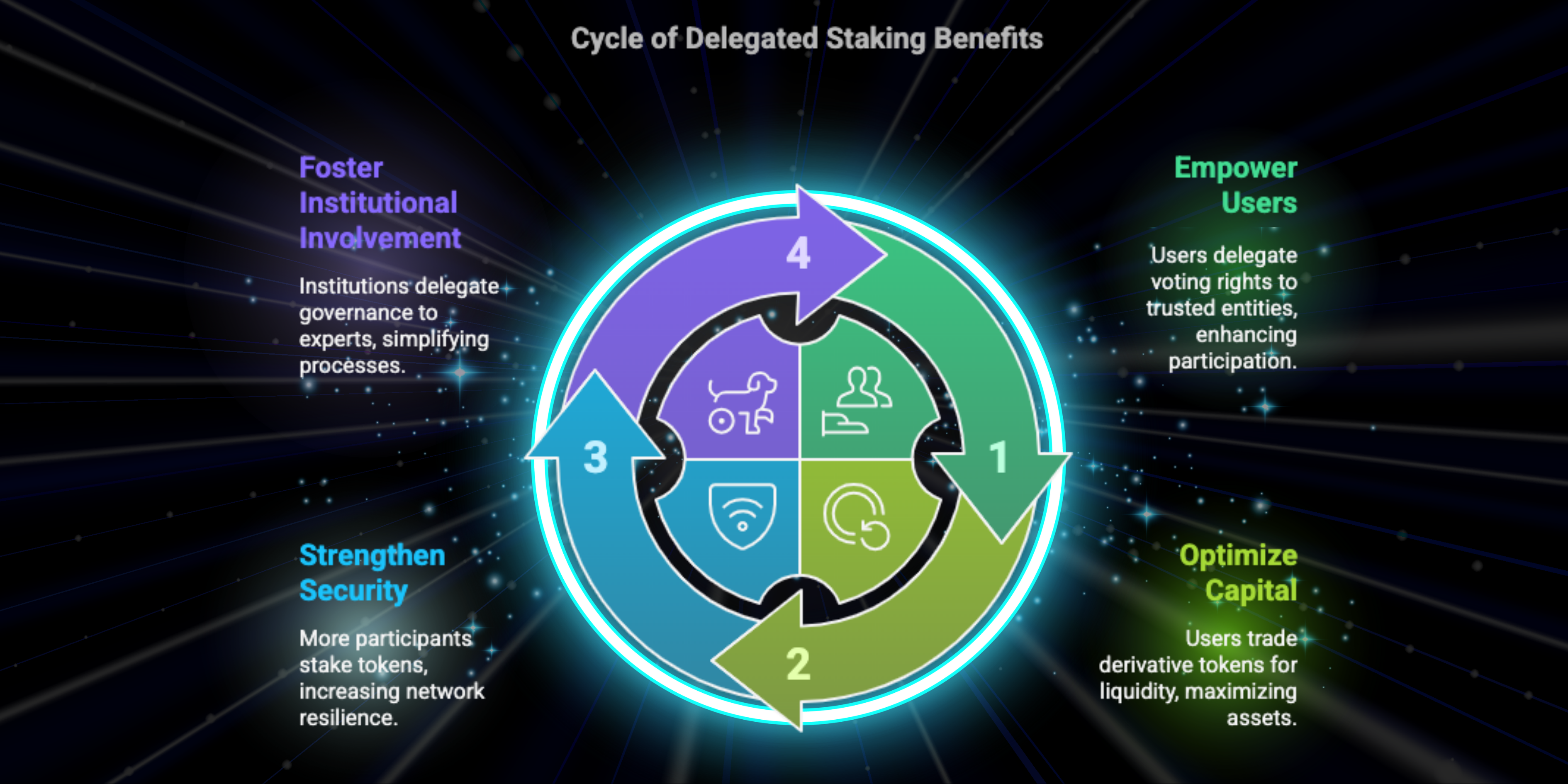

Enhanced Governance Participation

Delegated staking lowers the barrier to participation for users who may not have the expertise or time to engage in active governance. By assigning their voting rights to trusted entities or governance specialists, they ensure that informed decisions are made on their behalf. -

Improved Capital Efficiency

Users can stake their USST tokens while receiving derivative tokens representing their staked position. These tokens can be traded, used in DeFi applications, or deployed across other protocols, ensuring continuous liquidity without sacrificing staking rewards. -

Incentivized Network Security

Staked tokens contribute to the protocol’s overall security and stability. Delegated staking encourages more users to participate in securing the network, ensuring a stronger and more resilient blockchain infrastructure. -

Customizable Yield Generation

By leveraging derivative tokens, users can maximize their returns through yield farming, liquidity provision, or participating in lending protocols. This multi-layered earning potential fosters a more dynamic and profitable ecosystem. -

Support for Institutional Participation

Institutional investors and large-scale stakeholders may not prefer to manage individual governance decisions. Delegated staking enables them to assign their voting rights to experienced governance delegates or community leaders who act in their best interest.