STBL: USST Stability & Liquidity

STBL ensures USST stability and liquidity through a reserve-backed treasury model utilizing tokenized real-world assets (RWAs) such as U.S. Treasury Bills. These assets serve as collateral, guaranteeing that every USST stablecoin issued is fully backed and preventing supply imbalances.

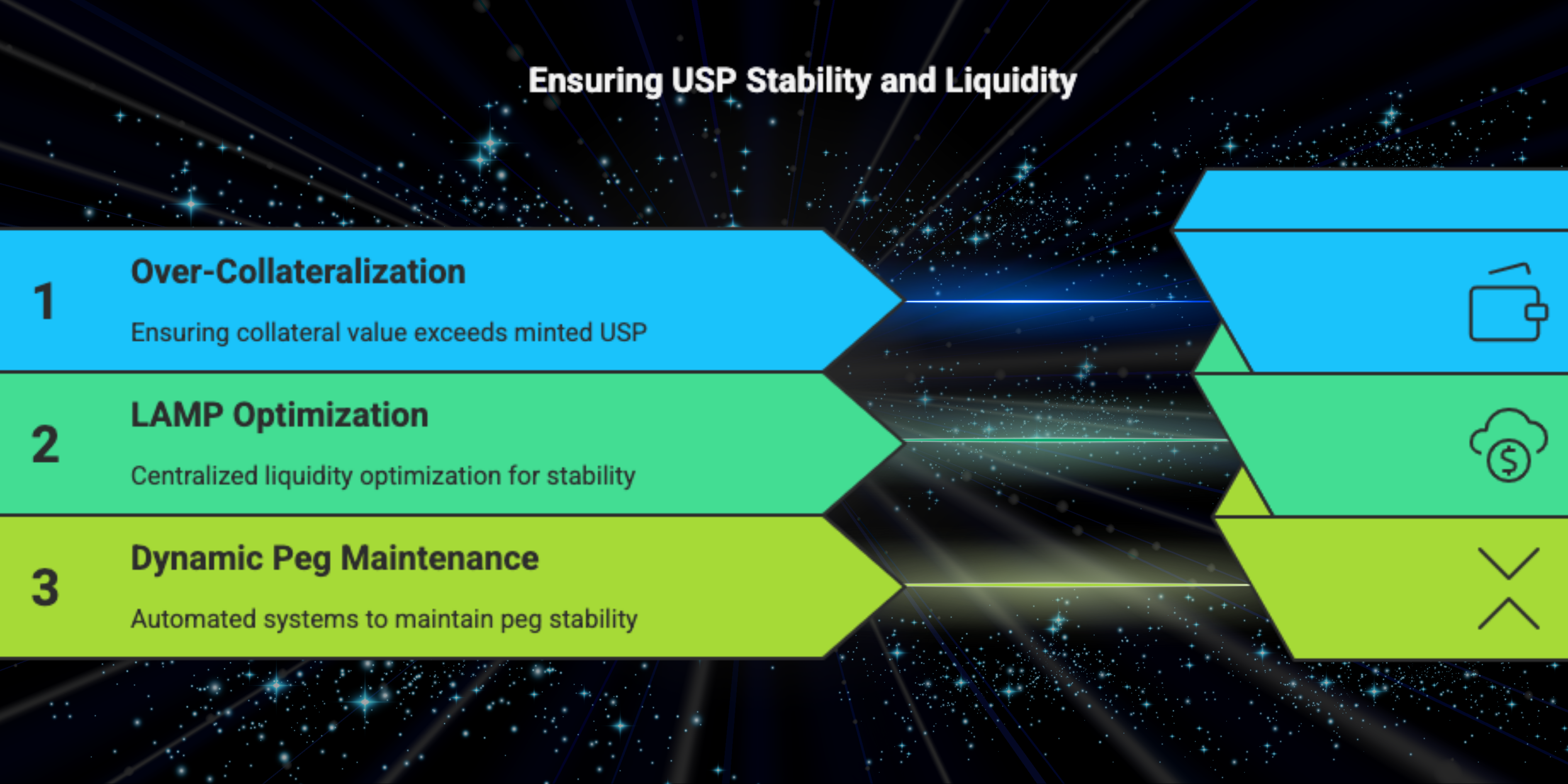

Collateral-Backed Security

- USST maintains a $1.00 peg, backed by verifiable RWAs rather than relying on fractional reserves like centralized stablecoins.

- The protocol employs an over-collateralization model, ensuring the collateral value exceeds the amount of USST minted to mitigate risks.

- The over-collateralization ratio (R) is calculated based on a volatility model of the RWAs, ensuring stability even in adverse market conditions.

- The Liquidity and Minting Pool (LAMP) acts as a centralized liquidity optimizer that enhances capital efficiency and price stability. It ensures USST is always distributed at a fixed price of $1.00, mitigating the risk of USST deviating from its intended peg.

Role of LAMP in Treasury Stability

The LAMP mechanism plays a critical role in:

- Providing immediate liquidity while maintaining a tight price peg for USST.

- Enabling users to allocate USST and YLD tokens for staking and earning governance rewards in USST.

- Allowing users to contribute to USST liquidity pools, ensuring constant market demand.

- Additionally, users who stake USST into the LAMP earn USST rewards, incentivizing long-term protocol participation.

Dynamic Peg Stability & Market Protection

To prevent USST from falling below $1.00, STBL integrates:

- An automated price moderation system within LAMP that dynamically adjusts USST issuance to maintain stability.

- Liquidity bootstrapping, ensuring USST supply remains equally distributed across lending protocols and decentralized exchanges (DEXs).