Long-Term Economic Stability

STBL is designed to ensure long-term economic stability by employing a combination of burn mechanisms, over-collateralization, and liquidity management. These features work together to maintain a self-sustaining financial ecosystem, supporting the protocol's core mission of offering a secure and reliable stablecoin.

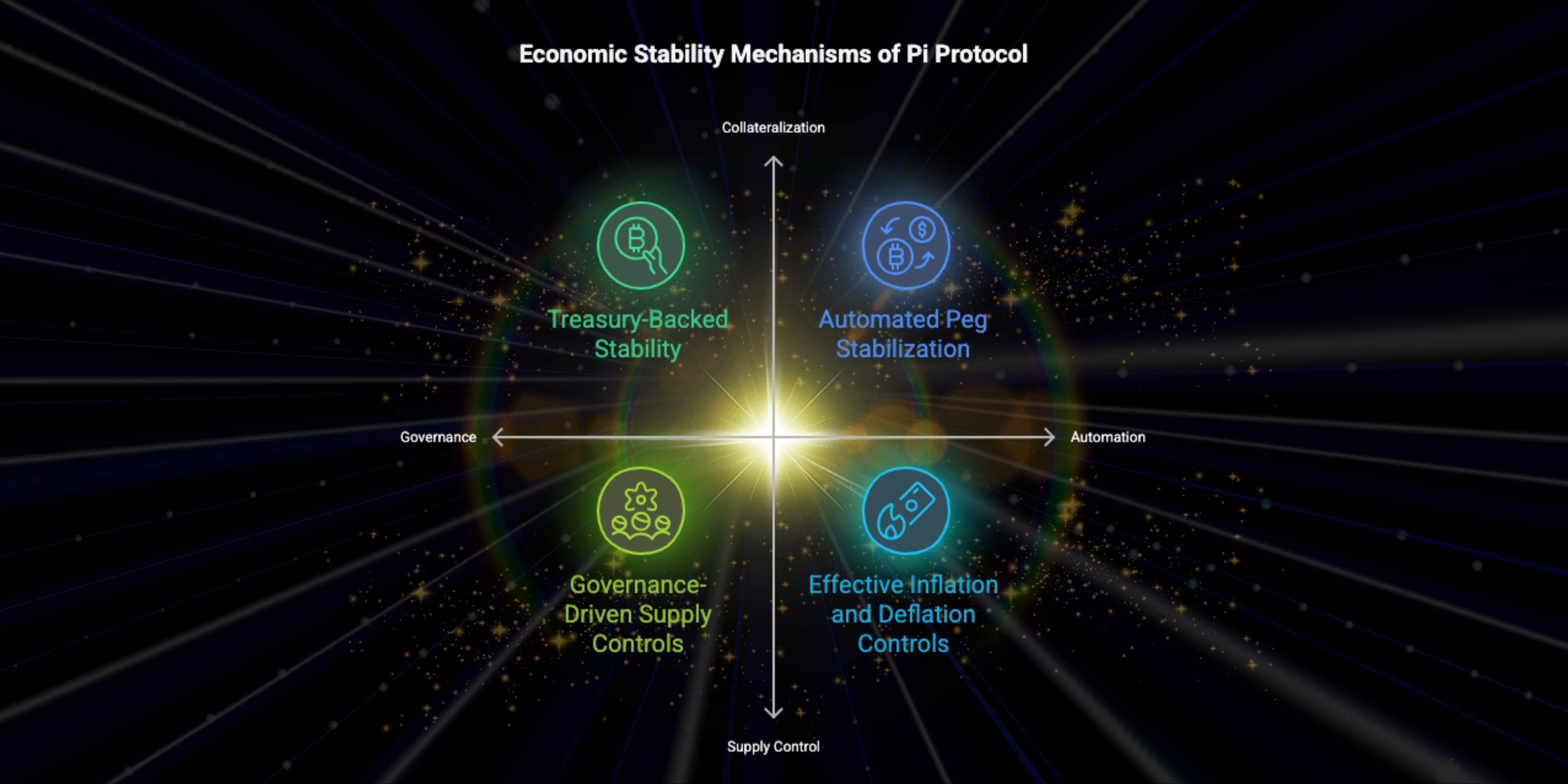

1. Treasury-Backed Stability

- Every USST stablecoin issued by STBL is backed by real-world tokenized assets (RWAs) like U.S. Treasury Bills.

- This ensures that all circulating USST remains fully collateralized, protecting the protocol from liquidity crises and maintaining user confidence.

2. Governance-Driven Supply Controls

- STBL uses a decentralized governance model where USST holders participate in key decision-making processes.

- Governance participants can vote on supply management policies, including minting and burning of USST and YLD tokens.

- This transparent and community-driven approach prevents centralized manipulation and ensures long-term stability.

3. Automated Peg Stabilization via LAMP

- The Liquidity and Minting Pool (LAMP) functions as an automatic stabilizer to manage inflationary and deflationary pressures.

- By dynamically adjusting minting rates and liquidity, LAMP keeps the supply of USST in line with market demand.

- This system prevents abrupt price fluctuations and maintains USST’s $1 peg.

4. Effective Inflation and Deflation Controls

- STBL integrates a burning mechanism to regulate the supply of USST and YLD tokens.

- Whenever USST is redeemed or YLD is exchanged, tokens are permanently removed from circulation, preventing supply excess.

- The over-collateralization model ensures additional protection during market volatility, providing a robust economic foundation.

5. Sustainable Ecosystem Growth

- With its balanced economic design, STBL promotes sustainable growth by encouraging long-term participation.

- Users benefit from stable returns through YLD tokens, while governance incentives drive continuous improvements.

- This circular model of yield generation, supply management, and community governance reinforces the protocol’s financial resilience.

In summary, STBL’s comprehensive stability mechanisms ensure its stablecoin remains secure, reliable, and sustainable over the long term, positioning it as a robust alternative in the decentralized finance ecosystem.