Token Utility

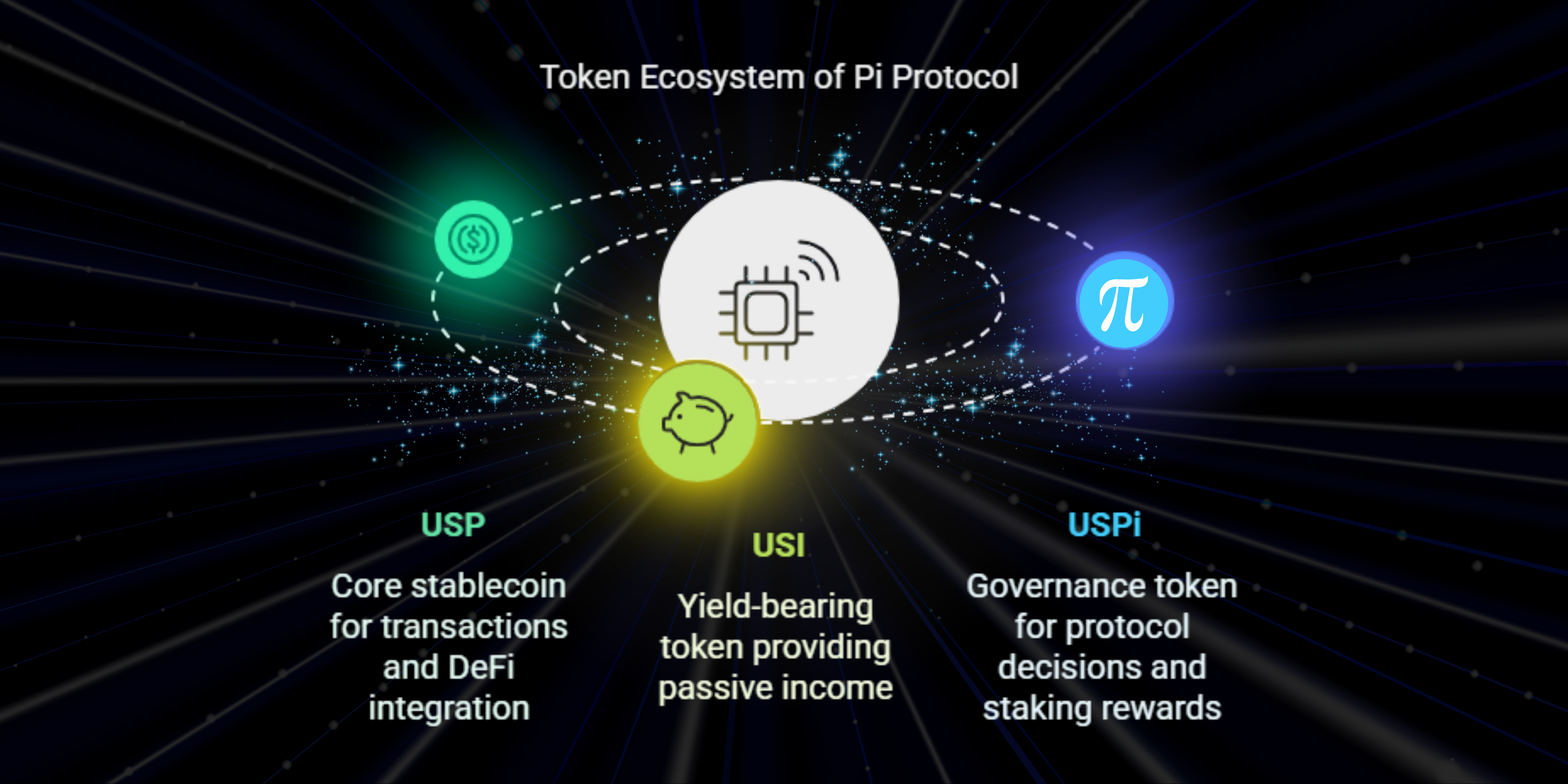

STBL’s token ecosystem is built around three key tokens that serve distinct functions within the protocol. Each token plays a vital role in enabling governance, staking, collateralization, and rewards.

1. USST – The Stablecoin for Transactions and Payments

USST is the core stablecoin of STBL, pegged to the U.S. dollar and backed by tokenized real-world assets (RWAs). It is used as a medium of exchange and provides a secure and decentralized alternative to traditional stablecoins.

Key Utilities of USST:

- Stable Transactions: Enables everyday payments with low volatility and high stability.

- DeFi Integration: Used in lending, borrowing, and liquidity provisioning in DeFi platforms.

- Medium of Exchange: Facilitates trading and commerce across blockchain networks.

- Liquidity Bootstrapping: When staked in the Liquidity and Minting Pool (LAMP), USST holders earn governance rewards in USST tokens.

2. YLD – The Yield-Bearing Token

YLD represents the accrued interest generated from RWAs and provides users with passive income without requiring them to actively stake or lock funds.

Key Utilities of YLD:

- Yield Accumulation: YLD tokens continuously generate interest based on the performance of the underlying collateral.

- Tradability: Can be traded on secondary markets or used as collateral for additional liquidity.

- Compounding Returns: Users can reinvest YLD into STBL to further increase their yield.

Unlike traditional yield models that rely on borrowing or leverage, STBL enables a risk-minimized approach where users earn sustainable returns through tokenized RWAs.

3. USST – The Governance and Incentive Token

USST is the governance token of STBL, granting holders the ability to participate in protocol decisions and access exclusive staking rewards.

Key Utilities of USST:

- Governance Participation: USST holders can vote on protocol upgrades, risk parameters, and treasury management decisions.

- Staking Rewards: Users can stake USST to earn additional incentives in the form of protocol fees and USST distributions.

- Collateral Functionality: Can be used to secure key protocol functions, enhancing the system’s stability.

- Incentivized Liquidity Contribution: Users who contribute to USST liquidity pools receive USST rewards, promoting a stable financial ecosystem.

Additionally, STBL introduces USST (Staked USST), a time-locked derivative of USST that amplifies voting rights and reward allocations based on the staking duration.

4. Incentives for Token Holders

To encourage ecosystem growth, STBL rewards active participants with additional benefits:

- Minters: Users who mint USST receive a share of governance rewards via USST tokens.

- Liquidity Providers: Those who provide liquidity for USST trading pairs earn transaction fees and protocol incentives.

- Long-Term Stakers: Users who lock USST or stake USST in LAMP gain higher rewards over time.