Introduction

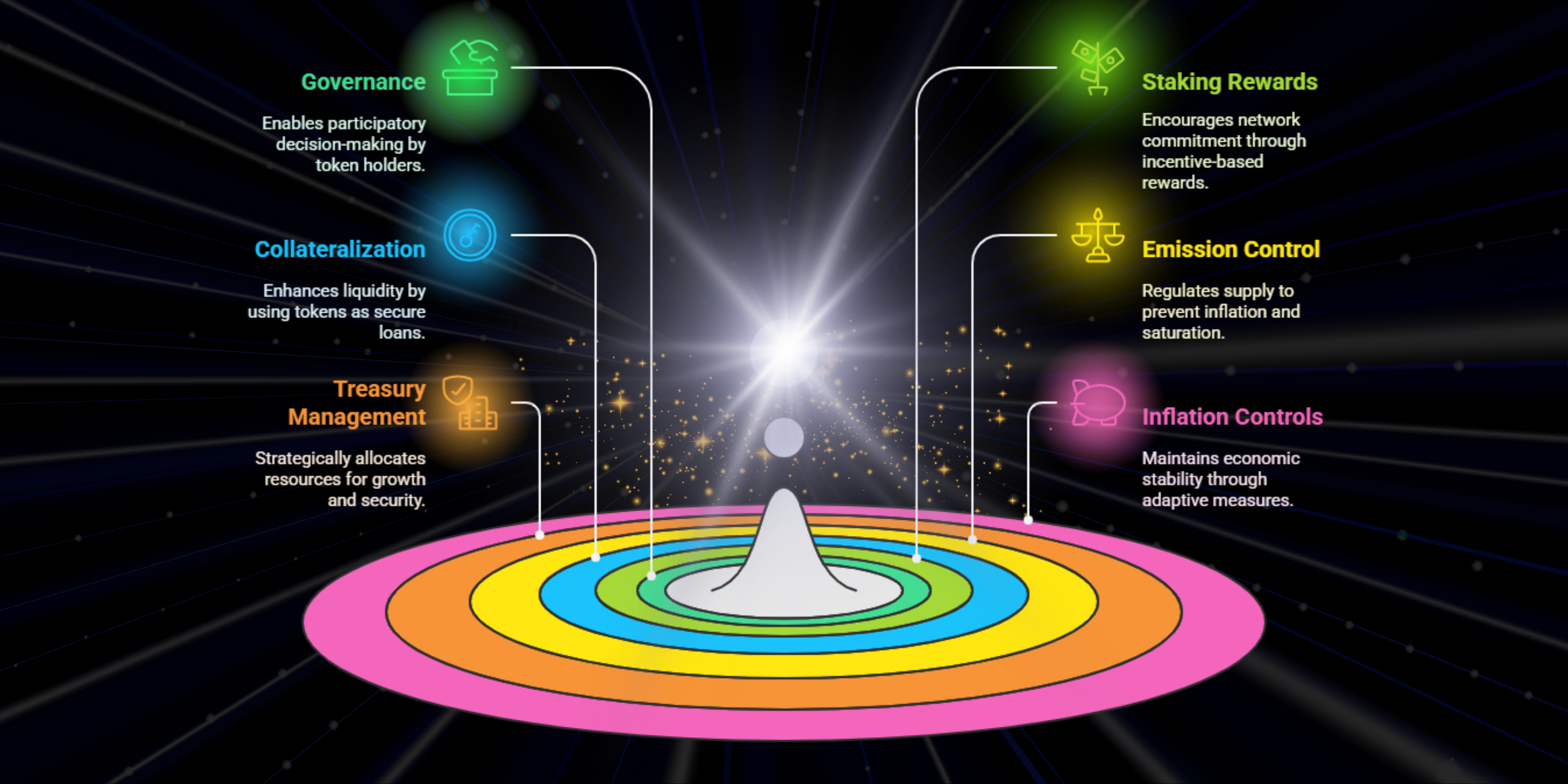

STBL’s tokenomics and financial model are designed to ensure stability, sustainability, and long-term value creation within the ecosystem. By utilizing a structured supply distribution, staking rewards, governance participation, and collateralization mechanisms, STBL enables efficient capital allocation and decentralized financial operations.

The protocol’s economic framework revolves around the utility of its tokens, which play a crucial role in governance, staking, collateralization, and yield generation. A well-defined emission schedule ensures controlled token supply, while treasury management mechanisms allocate resources for development, ecosystem growth, and protocol security. Additionally, STBL incorporates inflation and deflation controls to maintain value equilibrium and optimize liquidity.

Token Utility

STBL’s tokens serve key functions within the ecosystem, including:

- Governance – Token holders participate in protocol decisions.

- Staking – Users earn rewards by staking their tokens.

- Collateralization – Tokens can be used as collateral for borrowing.

- Rewards – Incentives for participation and ecosystem growth.

Emission Schedule & Supply Distribution

STBL follows a structured emission schedule to maintain controlled token supply and prevent inflationary risks. The supply distribution ensures:

- Fair allocation of tokens across ecosystem participants.

- Sustainable growth through phased token releases.

- Controlled supply dynamics to avoid excess market saturation.

Treasury Management & Yield Mechanisms

To maintain long-term sustainability, STBL employs treasury management strategies, including:

- Reserve allocation for ecosystem development and security.

- Yield distribution to reward participants through staking mechanisms.

- Protocol revenue reinvestment to support future growth.

Inflation & Deflation Controls

STBL integrates mechanisms to regulate token supply and maintain economic stability:

- Burn mechanisms to reduce excess supply and support token value.

- Adaptive issuance to balance liquidity and prevent inflationary pressures.

- Market-driven adjustments ensuring sustainable value creation.

By implementing these tokenomics strategies, STBL establishes a robust financial foundation, promoting stability, growth, and long-term value for all ecosystem participants.